Fidesmo API Integration

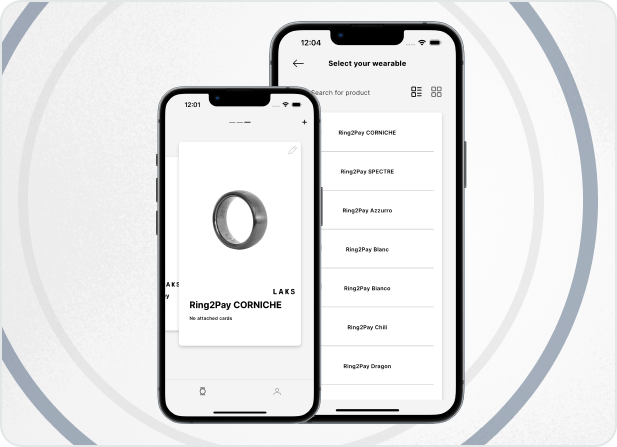

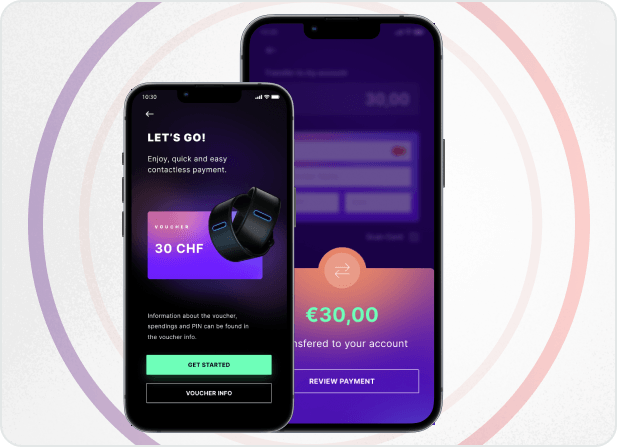

Silk Data helped LAKS, a major company in wearable payments, to switch their online payment system to Fidesmo. Fidesmo is a state-of-the-art contactless payment solution that enables seamless communication between wearable payment devices and banking institutions. Silk Data didn't just replaced payment system; our IT team also enhanced the payment management system to be more reliable and ready for future advancements.

Challenges

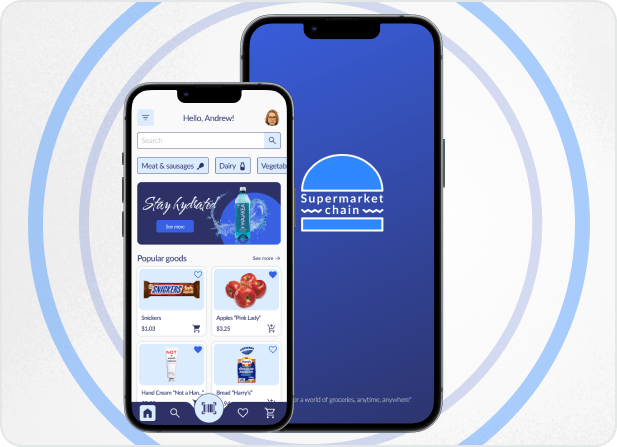

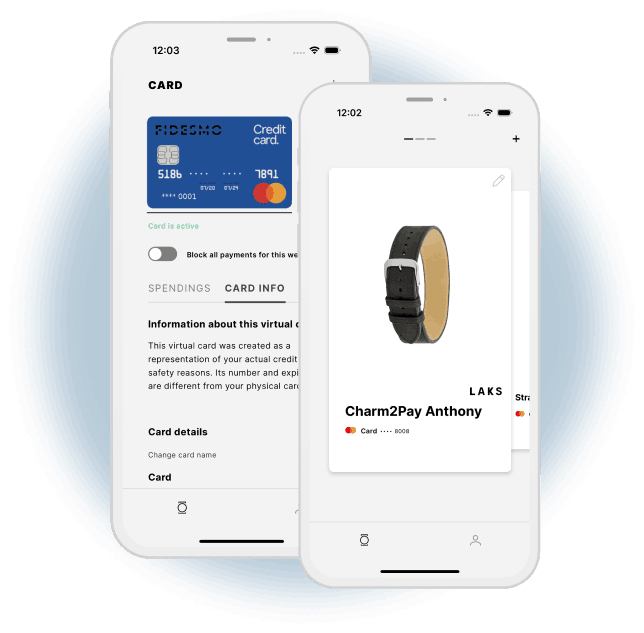

Through LAKS's convenient application for contactless payment, users can connect their wearable devices to virtual cards (MasterCard or Visa), ensuring secure interactions at any contactless terminal.

LAKS has decided to migrate their app to a new payment service, Fidesmo, to ensure secure and future-proof payment processing. The goal of this migration was not just to replace the legacy payment infrastructure but also to enhance the app’s payment management capabilities.

About the Client

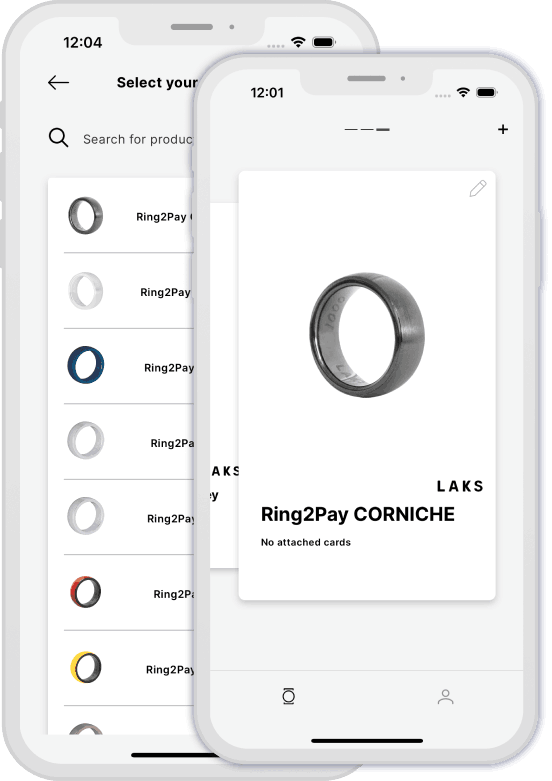

LAKS is a renowned innovator in the wearable payment industry, known for its stylish and functional NFC-enabled devices (watches, bracelets, rings, key fobs, etc.), all designed to facilitate secure and convenient contactless wearable payments.

Region

Austria

Time

1 month

Team

5

Solution

Relying on Silk Data as a mobile development company, LAKS turned to our mobile IT experts to migrate LAKS Pay to a new payment service that could handle banking communication and digital transactions efficiently.

LAKS offers wearable devices with a built-in NFC chip, the same secure contactless payment method used in credit cards. These devices work with LAKS Pay app to link them to virtual cards stored within the app.

LAKS chose Fidesmo as the new contactless payment integration for LAKS Pay to manage communication between wearable payment devices and banking institutions.

Fidesmo is a Swedish all-in-one platform that allows users to securely tap and pay with a variety of wearables.

Key Actions Taken

Core Functionality Overhaul

The team completely rewrote the logic governing bank transactions and communication within the application. This overhaul was critical to ensure the integrity and security of transactions processed through Fidesmo.

API Integration

Implementing Fidesmo’s payment API integration allowed LAKS Pay to facilitate secure communication between the NFC payment devices and banks. This integration supports various contactless payment devices including NFC payment ring, NFC bracelet, and watches. Fidesmo Pay provides enhanced security measures for transaction processing. It secures your transactions by using a token instead of your actual card number.

Seamless Transition

Integration within the LAKS Pay application reconnected existing wearable devices through Fidesmo, preserving their payment functionality. Without this integration, the legacy devices would have become non-operational. This crucial step ensured a smooth transition, maintaining the functionality of devices already in use.

Key Outcomes

Just within the month, Silk Data integrated the Fidesmo API into LAKS Pay.

Uninterrupted contactless services. (Users were able to continue using their NFC payment wearable devices without disruptions.)

Fidesmo’s robust security methods (e.g., tokenization) enhanced the overall safety of transactions, reinforcing user trust in LAKS Pay’s services.

With 10 years of experience in Android and iOS development, Silk Data specializes in creating applications for convenient transactions on wearable devices. Our expertise makes us uniquely qualified to integrate the Fidesmo API quickly, enhancing your app's tap-to-pay functionality with unmatched security.

Frequently Asked Questions

In a daily routine, a payment API (application programming interface) is a software tool that facilitates payment processing within applications, websites, or other digital platforms. These APIs enable businesses to accept various forms of payments, such as payment cards, digital wallets, and other online payment methods.

Here are three benefits of a payment API:

Security: A payment processor API makes it easy to minimize fraud risk by enhancing security with payment authentication methods (e.g., tokenized payments) and Payment Card Industry Data Security Standards (PCI DSS) compliance checks.

Scalability: Payment APIs can handle an increasing number of transactions as your business grows, allowing you to scale without worrying about your payment infrastructure.

Streamlined Operations: A payment gateway can handle repetitive tasks like subscriptions and bulk payments automatically, freeing up time for businesses to focus on other areas. This translates to faster real-time payments and easier management of refunds.

Tap to pay is a contactless way to make purchases using near-field communication (NFC) technology.

Here's how it works:

- Instead of swiping or inserting your card, you simply hold your contactless card, smartphone, or even a wearable device (e.g., watches, bracelets, payment ring, keychains) near a designated reader at the checkout terminal.

- NFC creates a secure wireless connection between your device and the terminal, transmitting the payment information for authorization.

- Once approved, the transaction is complete—fast and easy!

Contactless payment technology primarily uses NFC. NFC is a form of wireless communication that allows devices, such as smartphones and contactless cards, to exchange data when they are in close proximity, typically within 4 centimeters (about 1.57 in).

Here's a more detailed look at some technologies involved:

EMV (Europay, MasterCard, and Visa) Chip Technology:

EMV technology underpins contactless cards, providing a secure method for transactions through dynamic authentication. EMV chips store encrypted payment credentials, which change with each transaction to prevent fraud and skimming.

Tokenization:

This process replaces sensitive card details with a unique identifier (token) during transactions, ensuring that the actual card information is not exposed.

Digital Wallets:

Digital wallets (e.g., Apple Pay, Samsung Pay, Google Pay) store payment information on smartphones, which can be used for contactless transactions. They utilize NFC technology for communication and often incorporate additional layers of security, such as biometric authentication.