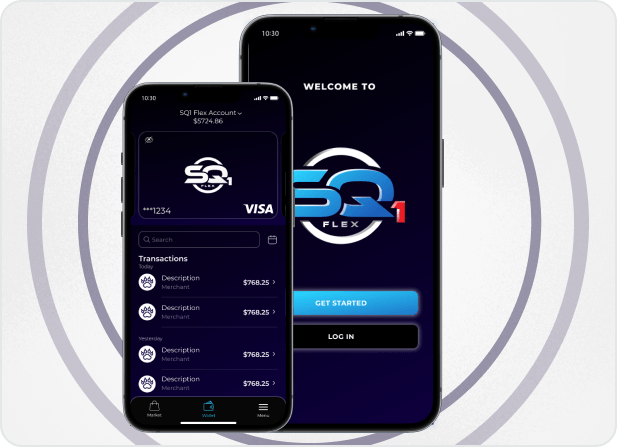

SQ1 – Mobile Payment Application Development

Challenge for Create Payment Application

To produce wearable devices more efficiently, the company needed a reliable mobile application for payment. This would allow users to link their credit cards, Flex Bands and NFC wearables and then monitor their payments. As the seamless application would be directly linked to the customer's personal information, it needed to be as secure as possible. Silk Data has extensive experience working with high-security Digital payment applications and in this case, our team understood how to fully meet the client's requirements. The team already had experience with NFC mobile payment apps for wearable devices for the Swatch company.

About the Project

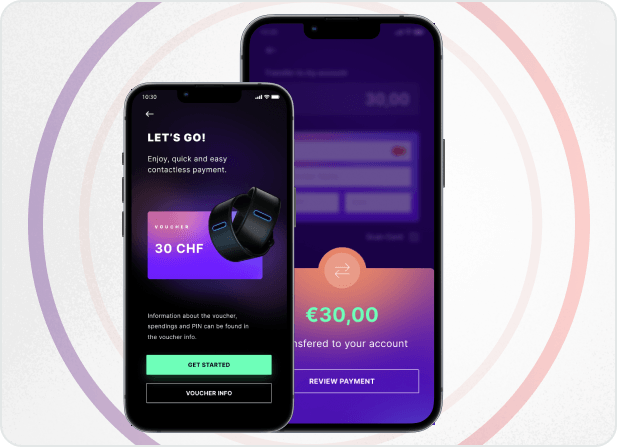

The Silk Data team developed a scalable payment application for iOS and Android platforms for contactless payment with a bracelet. The SQ1 FLEX mobile application makes it easy to control all Flex Band actions wherever you are.

USA

1.5 years

7 specialists

Solution - Wearable App Development

Solution - Wearable App Development

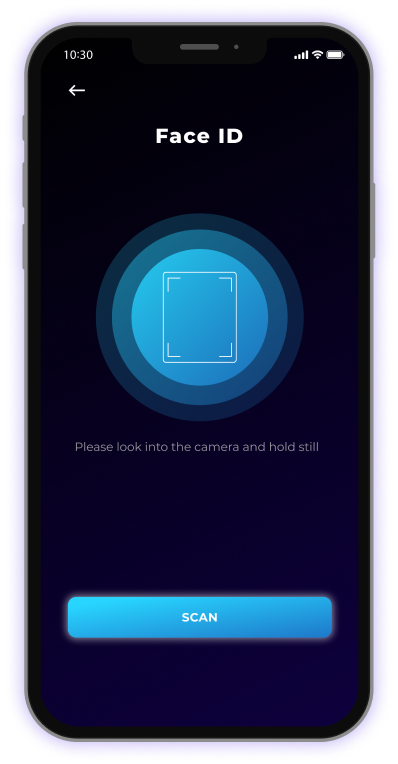

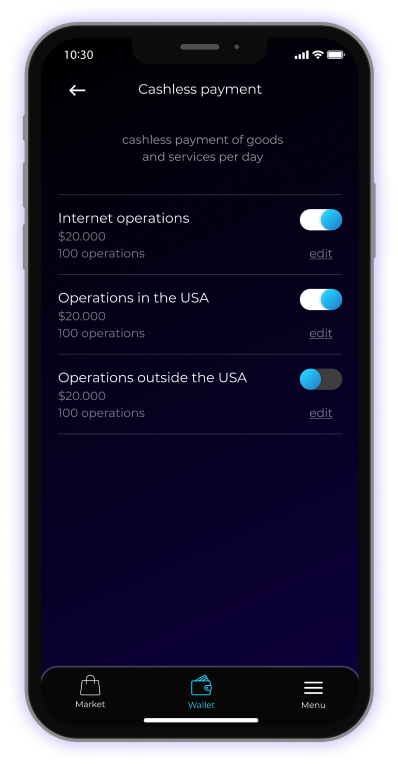

The solution provided by Silk Data is to create a payment app with numerous useful features. The main function of the application is to activate the smart Flex Band and use wearable payment technology.

Key Functionality NFC Payment Application:

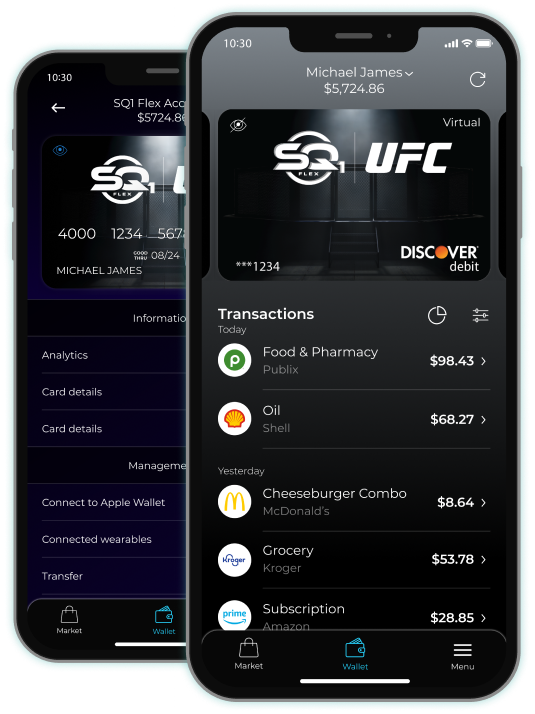

- Users can easily activate their wearable payment devices through the mobile NFC payment application by linking it to a credit card.

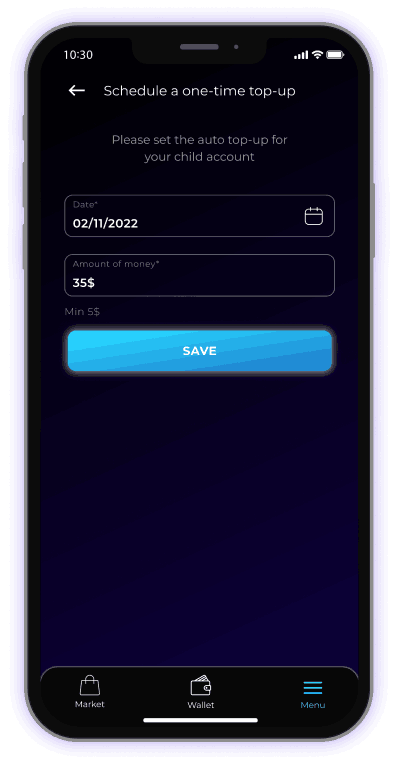

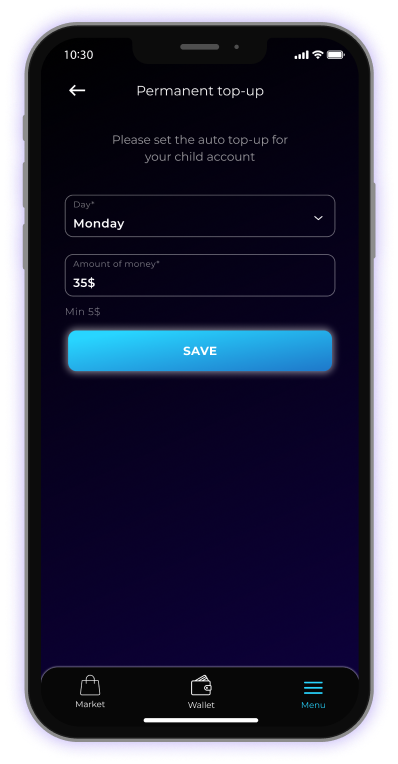

- End users can manage child allowances in contactless payment apps.

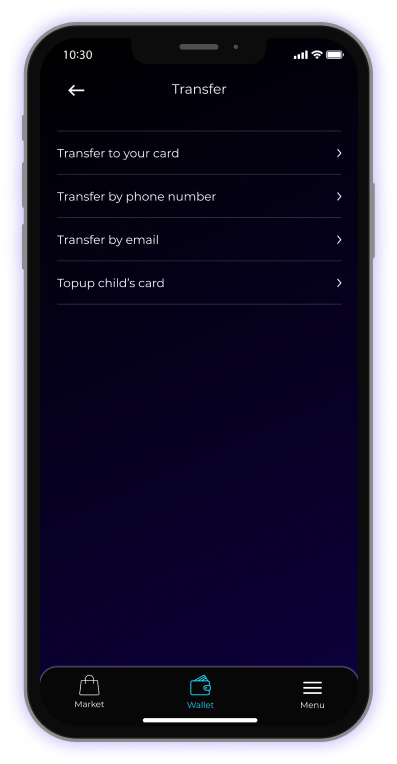

- Functionality for transferring money between users associated with Flex Band.

- Ability to lock the account if Flex Band is lost, ensuring the security of personal information.

- They can send and receive payments through the Innovation application.

- Users can conveniently top up their Flex Band account via the mobile application.

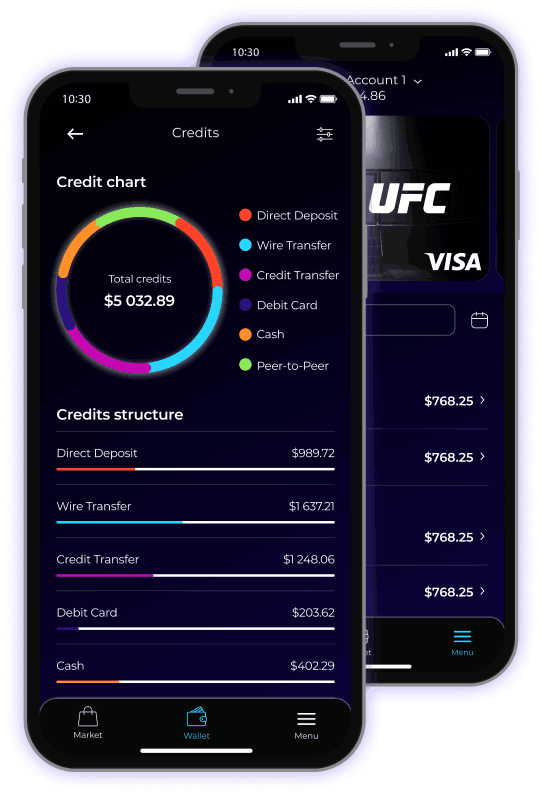

- Users can view and track their transactions, as well as receive information about rewards.

- Ability to track family expenses.

Key Results

Key Results

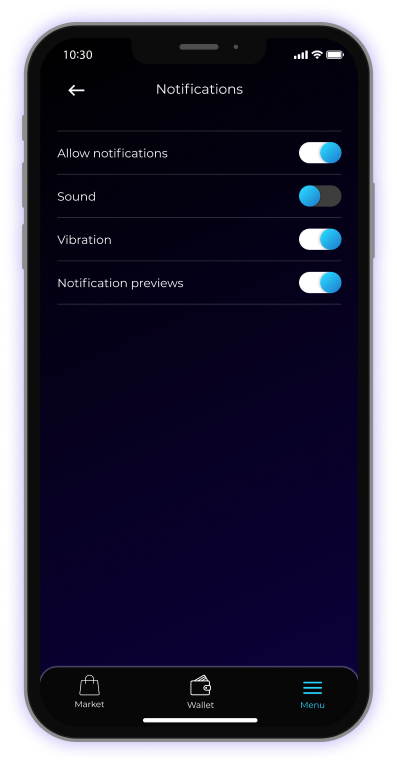

The wearable mobile app development is already available on the App Store and Google Play with over 12,500 downloads. This NFC mobile payment app has the potential to be promoted further. The payment app development facilitates a quick transition from traditional banking to online banking. It includes many useful features for managing cards and wearable devices, with reliable security and comprehensive customer support.

- An improved design concept was created, taking into account market trends.

- An adaptive interface fully aligned with business objectives during the build of a payment app.

- The client received two clickable prototypes before the actual implementation of the application.

Frequently Asked Questions

To develop payment software, begin by defining requirements, selecting a secure payment gateway, integrating with payment processors, and ensuring compliance with industry standards. Regularly update the software to address security concerns and evolving payment technologies.

Payment applications facilitate transactions by securely transmitting payment information between the payer, payee, and financial institutions. They use encryption protocols, secure APIs, and tokenization to protect sensitive data, ensuring seamless and safe financial transactions.

The cost of building a P2P payment app varies based on features, security measures, and development complexity. Expenses include design, development, testing, security, and ongoing maintenance. Budget considerations should also account for compliance with regulatory requirements.

Creating a payment gateway requires in-depth knowledge of payment processing, security protocols, and compliance standards. While it is technically possible to build one independently, partnering with established payment service providers can save time, resources, and ensure reliability.

An API payment gateway acts as an intermediary between an online merchant and the payment processor, enabling seamless and secure communication. It allows developers to integrate payment functionality into their applications, providing a standardized way to process transactions and handle payment-related data.